Škoda uses eye tracking in their marketing campaign

Microblink uses liveness detection for secure ID verification

-

Client:

Microblink

-

Technology:

Face tracking, liveness detection

-

Use case:

Liveness detection for secure ID verification

About Microblink

Microblink develops proprietary computer vision technology optimized for real-time processing on mobile devices. Using advanced neural networks and deep learning techniques, they ensure the fastest and the most accurate text recognition. Microblink’s goal is to improve user experience and engagement on mobile devices by eliminating the need to manually enter data.

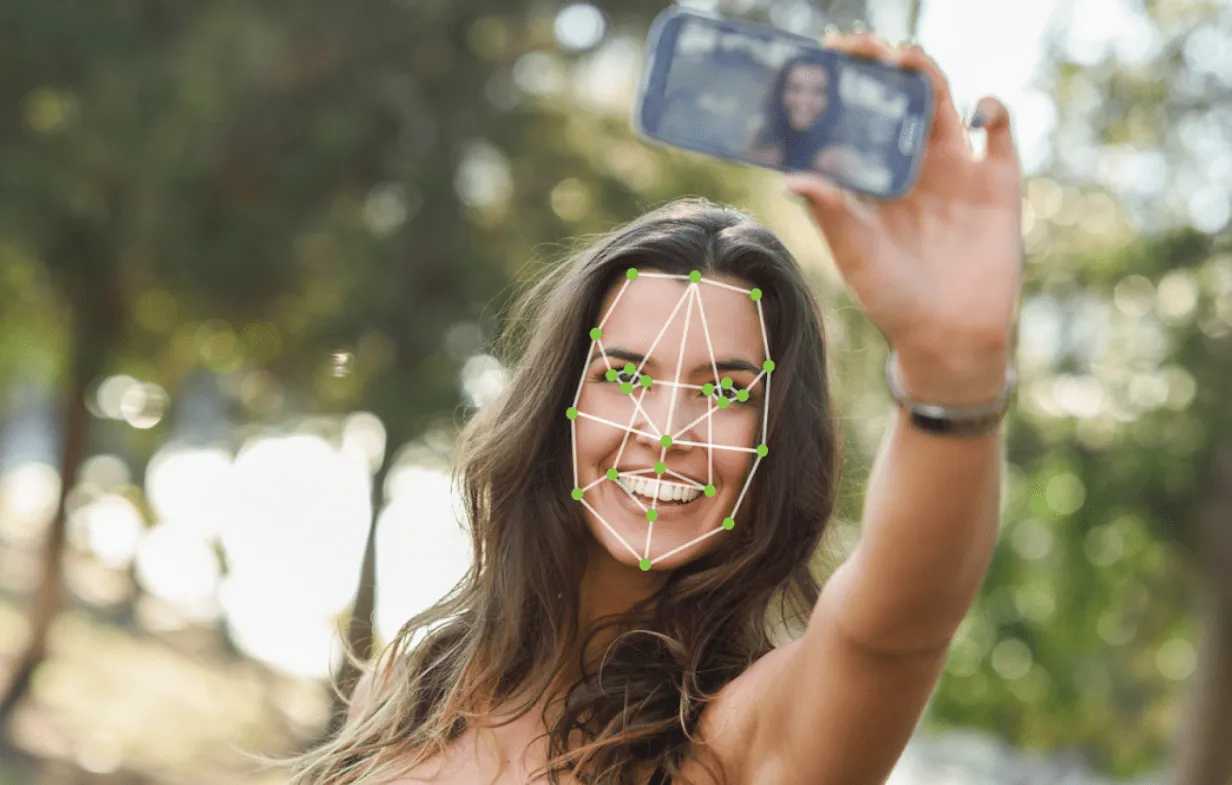

Improving safety with liveness detection

Fraud has become a major problem for businesses handling sensitive virtual transactions. Research has shown that 61% of fraud losses for banks stem from identity fraud. To make sure only the right person can access the right information, a more holistic approach to verification is needed.

Face recognition algorithms are easy to spoof using another person’s photos, prerecorded videos, and similar methods. Microblink needed a solution that would provide an additional security layer on top of their face recognition. That solution would prevent spoofing attacks without sacrificing user experience.

From performance to user experience potential, visage|SDK checked all the boxes:

- visage|SDK is quick and lightweight, so it can work flawlessly on mobile devices. It’s available for both Android and iOS.

- The SDK delivers accurate results with a broad range of cameras and resolutions, ensuring optimal performance on various devices.

- Face tracking works locally on any device, even with no Internet connection.

- Integration is easy with our detailed development guide, lots of customization options, and excellent technical support.

Integrating our face tracking technology resulted in quick and easy liveness detection via mobile devices.

Quick, easy and safe ID verification

Microblink’s BlinkID is an AI-powered tool that extracts data from documents such as IDs, passports, or driver licenses in real time. After scanning their ID document, the user points the phone camera towards their face and performs a few facial movements, such as blinking or smiling. This process, called liveness detection, ensures there is a live person in front of the camera and prevents spoofing attempts. Finally, the app tries to match the user’s face to the data that was previously extracted from their ID document.

For users, this process is extremely quick and easy. For businesses, it provides an additional layer of security and increased protection against fraud and identity theft. This is especially important for financial institutions that want to operate in virtual space without losing any sleep over ID issues.

A user-friendly interface, seamless scanning of identity documents, and reliable face recognition make Microblink’s software the perfect choice for businesses that put clients’ safety and convenience first.